USA

Every day, with LCL, as well as all with other transportation modes, logistics professionals take on a challenge - whether they can have their customer shipments reach their destination successfully and in the shortest transit time possible.

To give an overview of today’s shipping industry status, we need to consider the starting point. In March 2021, as per reports from JOC.com the reliability in the Asia–North America trade continued to slide, hitting new record lows for the month.

A severe shortage of railcars in Los Angeles–Long Beach is causing rail container dwell times to double, which is further stressing already congested terminals and inhibiting the ability of the terminals to ship imports to inland rail hubs.

The impact on the container shipping supply chain of the Suez Canal blockage will extend well beyond the refloating of the Ever Given.

Last but not least, any given week there are 30 vessels lined up at anchorage awaiting for a berth in Long Beach/Los Angeles.

All these factors together have hindered our customer satisfaction. Therefore, DACHSER is offering an urgent LCL with significantly shorter transit times from end-to-end – LCL Expedited Service.

The LCL Expedited Service connects China to the US and provide one of the best solutions in the current port/terminal congestion environment.

The service includes priority loading at origin, devanning at destination and selected carrier has owned dedicated terminal.

Amid this unfortunate situation, the USA is sharing a couple of success stories:

- customer Dana Lafayette has an urgent shipment from Shanghai ready by end of February and is required to deliver to Lafayette, IN no later than March 25. The LCL Expedited Service was called and shipment delivered on March 24 on time.

- In late March, the customer has a shipment sitting at origin in a competitor's warehouse for 2 weeks. They request DACHSER LCL Expedited Service again. We manage all shipment in a personalized manner. We are not only providing a short-term solution, but also building a long-term and trust relationship with our valuable customers.

Should you have any questions, please feel free to contact Sebastian Wulff, Head of Ocean Freight USA or Louis Wo, Sea Freight LCL Manager Americas.

Every day, with LCL, as well as all with other transportation modes, logistics professionals take on a challenge - whether they can have their customer shipments reach their destination successfully and in the shortest transit time possible.

To give an overview of today’s shipping industry status, we need to consider the starting point. In March 2021, as per reports from JOC.com the reliability in the Asia–North America trade continued to slide, hitting new record lows for the month.

A severe shortage of railcars in Los Angeles–Long Beach is causing rail container dwell times to double, which is further stressing already congested terminals and inhibiting the ability of the terminals to ship imports to inland rail hubs.

The impact on the container shipping supply chain of the Suez Canal blockage will extend well beyond the refloating of the Ever Given.

Last but not least, any given week there are 30 vessels lined up at anchorage awaiting for a berth in Long Beach/Los Angeles.

All these factors together have hindered our customer satisfaction. Therefore, DACHSER is offering an urgent LCL with significantly shorter transit times from end-to-end – LCL Expedited Service.

The LCL Expedited Service connects China to the US and provide one of the best solutions in the current port/terminal congestion environment.

The service includes priority loading at origin, devanning at destination and selected carrier has owned dedicated terminal.

Amid this unfortunate situation, the USA is sharing a couple of success stories:

- customer Dana Lafayette has an urgent shipment from Shanghai ready by end of February and is required to deliver to Lafayette, IN no later than March 25. The LCL Expedited Service was called and shipment delivered on March 24 on time.

- In late March, the customer has a shipment sitting at origin in a competitor's warehouse for 2 weeks. They request DACHSER LCL Expedited Service again. We manage all shipment in a personalized manner. We are not only providing a short-term solution, but also building a long-term and trust relationship with our valuable customers.

Should you have any questions, please feel free to contact Sebastian Wulff, Head of Ocean Freight USA or Louis Wo, Sea Freight LCL Manager Americas.

Chile

DACHSER Chile's trade volumes remains structurally positive, and have had an increase from 25% of own consolidated boxes from Hamburg to San Antonio in January 2021, to 50% in February 2021 and finally 75% in March. This is evidence of a strong commercial recovery of import volumes from Europe to Chile.

We have a weekly-consolidated service from Hamburg to San Antonio that covers the entire DACHSER Interlocking network in Europe benefiting from the Hamburg gateway.

Chile has a very open economy, highly dependent on international trade, which represented 56.8% of the country's GDP in 2019. The country mainly exports copper (which accounts for nearly half of its exports), fish fillets and other fish meat, chemical wood pulp, wine, and fruit (such as apricots, cherries, and peaches).

Imports involve petroleum oils, motor cars and other vehicles, electrical apparatus for line telephony, petroleum gas, and automatic data processing machines.

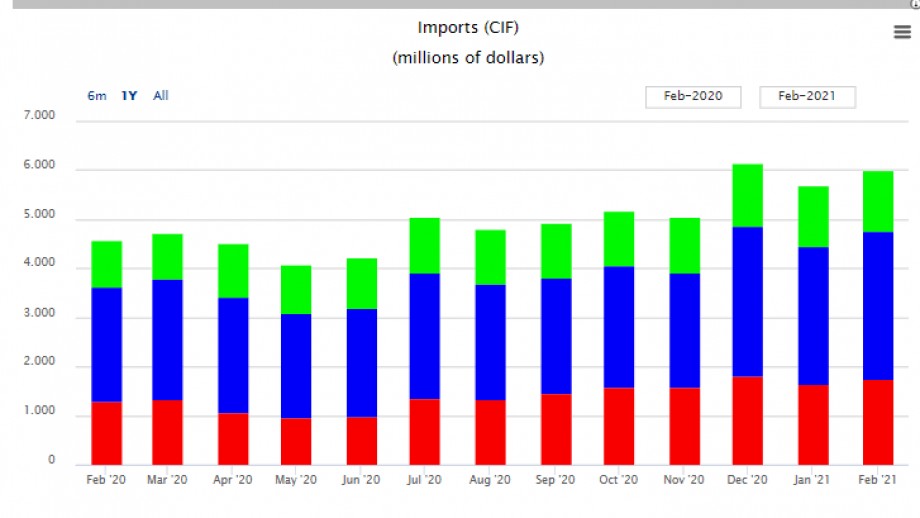

According to IMF Foreign Trade Forecasts, the volume of exports of goods and services decreased by 3.5% in 2020 and is expected to increase by 0.5% in 2021, while the volume of imports of goods and services decreased by 11.7% in 2020 and is expected to increase by 10.4% in 2021.

The unprecedented fall in volume of imports and exports in 2020 was due to the global economic crisis following the outbreak of the COVID-19 pandemic. However, by September 2020, trade was already showing signs of recovery, with ten of Chile’s sixteen regions experiencing a rise in export shipments.

Chile's top three exporting partners are China, the United States and Japan, while its main importers are China, the United States and Brazil. Chile has signed Free Trade Agreements (FTAs) with several important economies, notably the European Union, the United States, China and South Korea and is a member of the Pacific Alliance since 2012 with Mexico, Colombia and Peru.

Its comparative economic advantages (revenue from mining, competitive and counter-seasonal agriculture sector) have given it access to the large markets of North America, Europe and the Asia-Pacific (and recently to other South American countries, especially Brazil). Chile also signed a trade continuity agreement with the UK, ensuring continued trade relations. Challenges to Chilean trade include replacing the failed Union of South American Nations with ProSur to strengthen economic integration and trade relationships in the region (Buenos Aires Times). Additionally, with the world’s largest known copper reserves, Chile is a commodity-based, export-driven economy, which heightened Chile's exposure to the impact of the COVID-19 pandemic, since its economic performance is interlaced with patterns of global demand.

DACHSER Chile's trade volumes remains structurally positive, and have had an increase from 25% of own consolidated boxes from Hamburg to San Antonio in January 2021, to 50% in February 2021 and finally 75% in March. This is evidence of a strong commercial recovery of import volumes from Europe to Chile.

We have a weekly-consolidated service from Hamburg to San Antonio that covers the entire DACHSER Interlocking network in Europe benefiting from the Hamburg gateway.

Chile has a very open economy, highly dependent on international trade, which represented 56.8% of the country's GDP in 2019. The country mainly exports copper (which accounts for nearly half of its exports), fish fillets and other fish meat, chemical wood pulp, wine, and fruit (such as apricots, cherries, and peaches).

Imports involve petroleum oils, motor cars and other vehicles, electrical apparatus for line telephony, petroleum gas, and automatic data processing machines.

According to IMF Foreign Trade Forecasts, the volume of exports of goods and services decreased by 3.5% in 2020 and is expected to increase by 0.5% in 2021, while the volume of imports of goods and services decreased by 11.7% in 2020 and is expected to increase by 10.4% in 2021.

The unprecedented fall in volume of imports and exports in 2020 was due to the global economic crisis following the outbreak of the COVID-19 pandemic. However, by September 2020, trade was already showing signs of recovery, with ten of Chile’s sixteen regions experiencing a rise in export shipments.

Chile's top three exporting partners are China, the United States and Japan, while its main importers are China, the United States and Brazil. Chile has signed Free Trade Agreements (FTAs) with several important economies, notably the European Union, the United States, China and South Korea and is a member of the Pacific Alliance since 2012 with Mexico, Colombia and Peru.

Its comparative economic advantages (revenue from mining, competitive and counter-seasonal agriculture sector) have given it access to the large markets of North America, Europe and the Asia-Pacific (and recently to other South American countries, especially Brazil). Chile also signed a trade continuity agreement with the UK, ensuring continued trade relations. Challenges to Chilean trade include replacing the failed Union of South American Nations with ProSur to strengthen economic integration and trade relationships in the region (Buenos Aires Times). Additionally, with the world’s largest known copper reserves, Chile is a commodity-based, export-driven economy, which heightened Chile's exposure to the impact of the COVID-19 pandemic, since its economic performance is interlaced with patterns of global demand.

Peru

"Due to the current worldwide issue with space availability (and the pandemic), the LCL service is a great solution for moving cargo to/from Peru", says Ana Sofia Rotondo, Ocean Freight Manager, DACHSER Peru.

The top five trade countries import and export with DACHSER Peru are DE, FI, CN, US and ES. We will focus and continue to drive our LCL services to a higher level and benefit our customers and networks.

The biggest export partners of Peru are China (34 %), the United States (11%), Switzerland (7%), South Korea (6%), and India (6%). Canada and Chile are important export partners of Peru as well.

Since Peru is a nation rich in resources, the items that are majorly exported from Peru include ores, gems, copper, food industry waste, animal fodder, coffee, crotchet clothing/accessories, molybdenum, silver, crude petroleum, natural gas, asparagus, fruits (mangoes, avocados, bananas, citrus fruits), textiles, fishmeal, fabricated metal products, and alloys.

In the market imports, the year 2017, goods worth of 38 billion USD were imported into Peru, therefore making it the world’s 54th largest importer. The main items that are imported to Peru include petroleum/petroleum products, chemicals, plastic, machinery, wheat, corn, soybean products, vehicles, TV sets, front-end loaders, telecom equipment and telephones, paper, cotton, and medicines. A lot of Peru’s imports come in from China and the USA. Some of the other import partners include Argentina, Chile, Colombia, Ecuador, Mexico, Brazil, and Japan.

"Due to the current worldwide issue with space availability (and the pandemic), the LCL service is a great solution for moving cargo to/from Peru", says Ana Sofia Rotondo, Ocean Freight Manager, DACHSER Peru.

The top five trade countries import and export with DACHSER Peru are DE, FI, CN, US and ES. We will focus and continue to drive our LCL services to a higher level and benefit our customers and networks.

The biggest export partners of Peru are China (34 %), the United States (11%), Switzerland (7%), South Korea (6%), and India (6%). Canada and Chile are important export partners of Peru as well.

Since Peru is a nation rich in resources, the items that are majorly exported from Peru include ores, gems, copper, food industry waste, animal fodder, coffee, crotchet clothing/accessories, molybdenum, silver, crude petroleum, natural gas, asparagus, fruits (mangoes, avocados, bananas, citrus fruits), textiles, fishmeal, fabricated metal products, and alloys.

In the market imports, the year 2017, goods worth of 38 billion USD were imported into Peru, therefore making it the world’s 54th largest importer. The main items that are imported to Peru include petroleum/petroleum products, chemicals, plastic, machinery, wheat, corn, soybean products, vehicles, TV sets, front-end loaders, telecom equipment and telephones, paper, cotton, and medicines. A lot of Peru’s imports come in from China and the USA. Some of the other import partners include Argentina, Chile, Colombia, Ecuador, Mexico, Brazil, and Japan.

Mexico

Since 2020, the logistics industry faced many changes and challenges regarding rates, space and equipment availability. Even past the first quarter of 2021, some of the trades still remain on the same crisis level or even getting worse.

We continue to focus on the LCL development and have lead LCL business to grow and be part of the greater solutions we offer our valuable customers.

Cargo export from Mexico has not encountered as much terrible issues as import that Mexico is heavier in 70% Import and 30% Export; also having both coasts operation allows the country be very competitive to accomplish with all needs of the market.

The time to clear/release cargo in the ports of Mexico has been suffering and delays are prolonged as one of the issues related to new protocols and new time frames. DACHSER Mexico is starting a new solution in the market, offering Logistic Bridges from port to internal points as Queretaro & Puebla, to avoid long lines and delays for mainly our cargo specialty: the automotive industry.

The new service provides a safer move through the highways with an armored truck and we clear the cargo in internal customs where the Air business is their day-by-day, 90% of the cargo is cleared the same day. We are striving to provide our customers with optimal logistics solutions and customer satisfaction is our goal.

Should you have any questions or need further information, please feel free to contact RaulThomassiny, Ocean Product Manager, DACHSER Mexico.

Since 2020, the logistics industry faced many changes and challenges regarding rates, space and equipment availability. Even past the first quarter of 2021, some of the trades still remain on the same crisis level or even getting worse.

We continue to focus on the LCL development and have lead LCL business to grow and be part of the greater solutions we offer our valuable customers.

Cargo export from Mexico has not encountered as much terrible issues as import that Mexico is heavier in 70% Import and 30% Export; also having both coasts operation allows the country be very competitive to accomplish with all needs of the market.

The time to clear/release cargo in the ports of Mexico has been suffering and delays are prolonged as one of the issues related to new protocols and new time frames. DACHSER Mexico is starting a new solution in the market, offering Logistic Bridges from port to internal points as Queretaro & Puebla, to avoid long lines and delays for mainly our cargo specialty: the automotive industry.

The new service provides a safer move through the highways with an armored truck and we clear the cargo in internal customs where the Air business is their day-by-day, 90% of the cargo is cleared the same day. We are striving to provide our customers with optimal logistics solutions and customer satisfaction is our goal.

Should you have any questions or need further information, please feel free to contact RaulThomassiny, Ocean Product Manager, DACHSER Mexico.